The Idaho State Liquor Division provides safe and convenient access to liquor, promotes responsible enjoyment, and generates vital revenue for our state. Every dollar earned goes directly back to our communities, which means lower taxes for all of us and crucial funding for services that truly make a difference. Here’s how it helps:

Let all Idahoans know about the incredible benefits the Idaho State Liquor Division brings to our communities.

Let’s Share the Spirit!

This is your chance to win some exciting products from your favorite suppliers! Complete the form to be considered in the drawings.

Experience world-class skiing and the vibrant spirit of Aperol Spritz. March 22-27 at Sun Valley Resort

By Kevin Settles and Peter Goodwin, Bardenay Distilling Co.

February 25, 2025

Bardenay Distilling Co. – A New Chapter in Craft Spirits

Since opening the doors of the first restaurant and distillery in 1999, Bardenay has been passionate about creating exceptional food, handcrafted cocktails, and high-quality spirits under one roof. Now, with the launch of Bardenay Distilling Co., they’re taking that passion to the next level, bringing craft front and center like never before.

A Legacy of Innovation

Bardenay made U.S. history in 1999 as the first restaurant to be issued a distillery permit to operate in a public place. According to owner Kevin Settles, it all started because he became interested in the distilling industry after he founded a hard cider company in 1987. Also, Settles began enjoying gin martinis with his meals during his travels and eventually started making them at home. These concepts gave him the idea and vision behind Bardenay.

Settles decided to sell the cider business in 1996. The agreement, however, included him to stay employed in the cider business for another three years. During that 3-year timeframe, he developed the full concept of a restaurant with a distillery, and he spent his spare time researching distillation and the rules governing distilleries. In 1999, a bill was sent to the Idaho legislature that allowed an Idaho distiller to hold a state liquor by the drink license, under certain conditions. The bill passed then Settles focused his attention on federal licensing. That wound up being a month-long process as no distillery had ever been issued a permit allowing operations in a public space. Eventually, Settles convinced the Bureau of Alcohol, Tax, and Tobacco (which is now the Alcohol and Tobacco Tax and Trade Bureau (TTB)) that operations would be safe and that Bardenay could comply with all regulations even though the distillery operated inside a restaurant.

Over the years, they have grown from a small operation in a renovated 100-year-old downtown Boise warehouse to a multi-location distilling powerhouse, with each location uniquely producing its own specific line of Bardenay spirits. The Boise location crafts the rum and ginger rum, all out of a 55-gallon pot still; the Eagle location opened in 2003 and specializes in gin and liqueurs; and the Coeur d’Alene location, which opened in 2007, handles vodka production. Now, with Bardenay Distilling Co., they are expanding the aged spirits program to include American whiskey, rye whiskey, and aged rum.

The commitment to hospitality extends beyond the Bardenay-named locations. With the addition of Coyne’s Restaurant, established in Eagle, Idaho in March 2020, the team created a restaurant that truly feels like home. They incorporated flavors from their team’s collective past – backyard barbecues, family picnics, and their grandmothers’ secret recipes. While Bardenay is lively and energetic, Coyne’s offers a more intimate, laid-back dining experience – another way they continue to bring people together through food and drink.

An Invitation to Visit

The new Boise Distilling Co. which opened its doors February 20, 2025, is not just another Bardenay location – is an entirely new experience. Unlike traditional Bardenay locations where the restaurant takes center stage, the new Garden City site is all about the art and science of distillation. Guests can tour the facility, watch the distillers at work, and even purchase a bottle of their favorite spirit – right from the source.

The chefs also developed a new menu for this location. Since it’s just a short drive from the flagship restaurant downtown, they wanted to offer something fresh while still delivering the signature Bardenay experience – great food, expertly crafted cocktails, and outstanding service.

“Bardenay Distilling Co. marks a new chapter,” stated Kevin Settles. “It is allowing us to focus more on retail sales and distillery production while continuing to innovate in the restaurant space. This latest venture ensures that commitment to quality, craftsmanship, and hospitality remains at the heart of everything we do as we grow. We invite you to visit all our unique locations and experience the new Bardenay Distilling Co. process firsthand. We look forward to seeing you and thank you for helping us raise a glass to the next generation of Bardenay spirits – Cheers!”

Idaho Liquor Sales Results

| DOLLAR SALES COMPARISON | |||||||

| January | Fiscal Year-to-Date | ||||||

| FY 2025 | FY 2024 | % Chg | FY 2025 | FY 2024 | % Chg | ||

| District 1 | 10,442,351 | 10,457,170 | -0.1% | 90,543,203 | 89,621,036 | 1.0% | |

| District 2 | 5,519,301 | 5,495,502 | 0.4% | 46,035,425 | 46,589,845 | -1.2% | |

| District 3 | 6,223,214 | 6,108,562 | 1.9% | 56,550,004 | 57,109,001 | -1.0% | |

| TOTAL | $22,184,866 | $22,061,233 | 0.6% | $193,128,631 | $193,319,882 | -0.1% | |

| VOLUME SALES COMPARISON | |||||||

| January | Fiscal Year-to-Date | ||||||

| FY 2025 | FY 2024 | % Chg | FY 2025 | FY 2024 | % Chg | ||

| 9-Liter Cases | 98,479 | 98,526 | 0.0% | 825,544 | 839,684 | -1.7% | |

| $ Sales/9L Case | $225.28 | $223.91 | 0.6% | $233.94 | $230.23 | 1.6% | |

| Bottles | 1,102,047 | 1,065,988 | 3.4% | 9,322,834 | 9,542,345 | -2.3% | |

| $ Sales/Bottle | $20.13 | $20.70 | -2.7% | $20.72 | $20.26 | 2.3% | |

January sales finished up +0.6% vs. last year. The month’s results were impacted by a favorable calendar effect, as this January had an additional Thursday/Friday vs. one less Monday/Tuesday. This impacted Sales by approximately +$695K or +3.2%. January results were actually down an adjusted -2.6% factoring out the calendar effect, which is a fair amount below the calendar year-to-date trend. I think it’s safe to say that ‘Dry January’ is definitely a thing. In real terms, this January is easily the poorest performing month in years. Last January was down an adjusted -3.0%, so we’ve taken a sizable dip even cycling a soft month. I can imagine the recent advisory from the Surgeon General contributed to softer sales this month, as well.

Now for the good news: all of the softness occurred in the first two weeks of the month. Halfway through January, Sales were down -4.5%. In order to rally and finish the month down -2.6%, the last half of the month decreased only -0.7%. From where I’m standing, it looks like ‘Dry January’ became ‘Damp January’ in the back half of the month. This provides some optimism that February may return to the YTD trend. Next month should be very interesting. Apparently, ‘Wet February’ is a thing, too. However, preliminary results indicate that February sales will finish down -1.2% vs. a year ago. Looks like we’re going to have another month that is fairly soft relative to year-to-date trends.

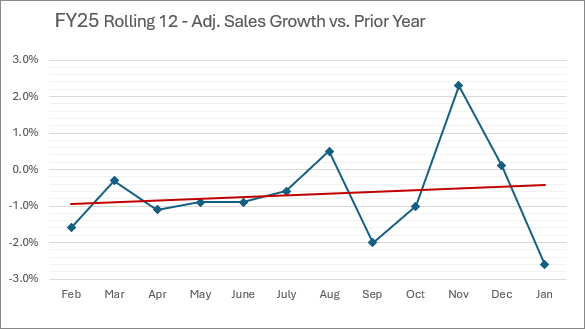

Here’s a look at adjusted sales growth over the past 12 months:

The red trendline above does suggest some stability, but results have been anything but stable the last 6 months. There’s an awful lot of volatility from month-to-month right now, as consumers can’t seem to decide how they feel about the various things that affect alcohol sales e.g., the economy, politics, lifestyle, New Year’s resolutions, etc.

One of the more interesting statistics of the month is that bottle sales actually increased vs. last January, significantly belying year-to-date trends. At the same time, the average bottle price for the month decreased. You can probably guess what happened in January. That’s right, all positivity in bottle sales came from small sizes, specifically 50MLs. This is noteworthy because 50MLs had been trending negative all fiscal year heading into January. Perhaps recent tweaks to how we display small sizes is having an impact.

We’ve been hearing a lot lately about customers’ increased interest in small sizes, and that these smaller packages are an avenue for offsetting volume declines in larger sizes. You’ll see in the box below that bottle sales have been declining over the past 12 months pretty much across the board. Even single 50ml bottles have been declining. However, the bundle packs (multi 50ml bottles) are definitely performing well, especially this fiscal year. Note that the 200 ml (4x50ml) and the 500 ml (10x50ml) below represent bundle packs of 50ml bottles.

| Bottle Sales % Chg. | ||

| Size (ML) | Rolling 12 | FYTD |

| 50 | -11.1% | -12.2% |

| 200 | -5.1% | 20.4% |

| 375 | -3.2% | -2.4% |

| 500 | 58.2% | 74.5% |

| 750 | -3.8% | -2.6% |

| 1000 | -1.4% | -0.8% |

| 1750 | -3.3% | -2.7% |

However, it’s important to bear in mind that although the 50ml bundle packs are performing well, they still represent a very small portion of our business. Our bread and butter (i.e., 50, 375, 750, 1000, 1750) make up over 99% of our business, and that 92% of our topline sales are in the three largest sizes. 50ml bundle packs may be a growth opportunity, but they’re far from being a game changer.

| Size (ML) | R12 Dollar Sales | % of Sales |

| 50 | 7,148,299 | 2.4% |

| 200 | 793,692 | 0.3% |

| 375 | 13,948,097 | 4.7% |

| 500 | 1,170,019 | 0.4% |

| 750 | 138,147,499 | 46.4% |

| 1000 | 51,045,909 | 17.1% |

| 1750 | 85,530,488 | 28.7% |

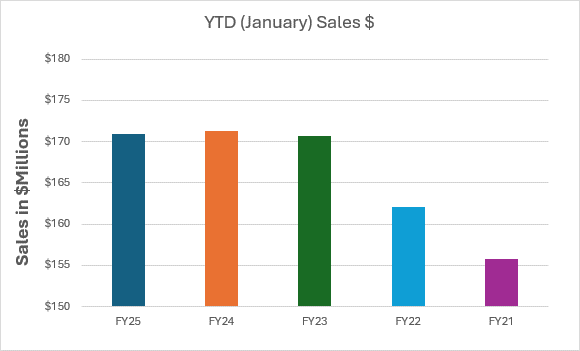

As much as we discuss the state of the industry and declines in consumption, it’s important to keep some perspective. Have a look at this:

The ISLD’s highest-ever year for sales was in FY23. Through seven months of the fiscal year, we’re currently on a pace to exceed FY23. The population is drinking less but still spending about the same amount on liquor as they have in the past.

Thank you for visiting our site! Sign up for our e-newsletter to stay informed about lotteries, barrel releases, seasonal and special items, and various other happenings in the liquor industry.